Understanding Mutual Fund Capital Gain Distributions

Background

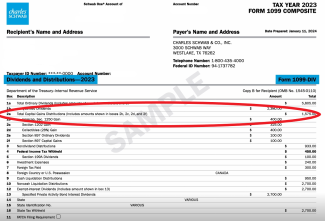

Many investors are often confused or surprised when they receive their year-end Mutual Fund tax statement (1099s) and see a significant Capital Gains amount, despite the fact they had not sold any shares of the fund during the referenced tax year.

This white paper will explain the difference between investor-induced capital gains and mutual fund manager-induced capital gain distributions, and detail how an investor can be better prepared to manage capital gain distributions and any related tax burden.

Definitions

Capital Gain

A Capital Gain occurs when the mutual fund shareholder sells shares of the fund during the specific tax year, at a value greater than the cost basis of the shares. In this case, the fund shareholder induces the sale, and should thus be well aware of the projected Capital Gain (or Loss).

Capital Gain Distribution

Capital Gain Distributions occur when the mutual fund manager decides to sell assets within the fund during the tax year. Such a sale may be due to the changing market outlook, to maintain the fund’s stated allocation, or to raise cash for shareholder redemptions.

The fund must distribute at least 95% of its gains from these sales to the fund shareholders, which will result in a capital gain for shareholders if the asset is trading higher on the sale date than when the fund manager initially purchased it. These capital gains may be paid to the fund shareholder or reinvested into additional shares of the mutual fund on the ex-dividend date – in both of these cases, the capital gain distributions are considered earnings.

Capital Gain Distributions are typically paid to the fund shareholders in November or December. Unless a taxable fund shareholder is monitoring the mutual fund transactions and pending capital gain distributions, they may be caught unaware of a tax obligation related to capital gain distributions when they receive their end-of-year mutual fund statements and tax forms.

How does a mutual fund capital gain distribution work?

Let us use an example:

- You own 1,000 shares of the Brayden Mutual Fund, and you reinvest all capital gains and dividends into additional shares of the Brayden Mutual Fund.

- The Brayden Mutual Fund has 1,000,000 shares and a Net Asset Value of $10 per share. Thus, your investment in the fund equals $10,000 (1,000 shares times $10 per share).

- Suppose the Brayden Mutual Fund purchased 10,000 shares of Brynley Inc. stock five years ago for $1 per share. The fund sells all of the shares today for $20 per share, which results in a gain of $19 per share or $190,000 total.

- The Brayden Mutual Fund manager must distribute the $190,000 gain to fund shareholders within the tax year of the transaction. These distributions are typically paid in November or December.

- The gain is equally distributed to all shareholders of the Brayden Mutual Fund, based on the number of shares held on the distribution date. The gain to be distributed will be $0.19 per share ($190,000 gain split across 1,000,000 shares).

- When the fund distributes its capital gain distributions, presuming you still hold 1,000 shares of the fund on that date, you will receive a capital gain distribution of $190 ($0.19 gain per share times 1,000 shares held).

- In conjunction with the capital gain distribution payout, the Net Asset Value of the Brayden Mutual Fund will be reduced by the total payout amount ($190,000), resulting in an adjusted Net Asset Value of ($10,000,000 - $190,000) / 1,000,000 = $9.81 per share.

- Thus, after the distribution is paid, you have the same total amount of assets ($190 capital gain distribution plus $9,810 in resultant mutual fund share value). However, as we will describe in the next section, you may be liable for taxes on the $190 distribution.

How are mutual fund capital gain distributions taxed?

If the shareholder’s fund in the example above is held in a taxable account, they must report capital gain distributions on their personal tax returns for the year in which the distribution was received. In this case, the gains are taxed as long-term capital gains at a rate of 0%, 15% or 20% based on the shareholder’s total income and the capital gain distribution may not be advantageous for the investor if they expected to sell shares at a later date when their total income tax bracket may have been lower, or if the gains impact the tax rate on other sources of income or benefits such as Social Security and Medicare.

If the shareholder’s fund in the example above is held in a tax-deferred retirement account such as an IRA or 401(k), taxes on the capital gain distributions are not due until funds are withdrawn from the tax-deferred account. This is due to the tax-deferred nature of these accounts - contributions and earnings are only taxed when distributions are taken. All of the distributions from such tax-deferred funds are taxed as ordinary income.

If the shareholder’s fund in the example above is held in a Roth retirement account (i.e., funded with post-tax contributions), there is no tax on the capital gain distributions as long as the distributions from the Roth account meet the IRS guidelines for qualified distributions.

Suggestions for managing capital gains on mutual funds

- Focus on low-turnover-rate funds if you own mutual funds in a taxable account. Funds with low turnover rates include index funds, tax-efficient mutual funds, and some actively managed funds. Turnover rate refers to the percentage of the fund’s total holdings that changes during the year. The higher the turnover rate, the more the fund is buying and selling internal assets, leading to tax consequences.

- Invest in mutual funds in a tax-deferred or tax-free account such as an IRA or 401(k).

- For taxable investment accounts, invest in a similar ETF to the mutual fund you are considering, as there may be tax advantages with ETFs in certain cases. See: ETF versus Mutual Fund Taxes – Fidelity for more information on this subject. Note that Mutual Funds may have advantages over a similar ETF, such as support for automatic withdrawals and purchases that are not supported by ETFs, which may make the mutual fund option more appealing. Refer to our Research Paper on the Differences between ETFs and Mutual Funds for more information.

- Visit your mutual fund company's website at the start of October each year to find out whether and when there will be capital gains distributions. Weigh the pros and cons of owning the fund if you expect the distributions to be large. You might want to sell the fund to avoid the distribution and the tax bill that will come with it.

- If you know that you will have capital gains related to certain assets, consider selling other assets that are at a loss to offset the gains. This is known as tax loss harvesting, which will be covered in a separate research paper. If you are not familiar with the IRS wash sale rules which may impact a tax loss harvesting plan, please consult with a financial professional before taking such action.

- In taxable accounts, don’t purchase shares of a mutual fund shortly before the date when the capital gain distributions are paid, in order to avoid paying taxes on these gains. This is referred to as avoiding “buying the distribution”.

- Hold mutual fund investments for the long-term (at least a year). This allows the investor to reduce the capital gains tax on their elective liquidation of the asset but does not affect fund-incurred capital gain distributions.

Summary

It is important to be mindful of the tax consequences of owning mutual funds. Mutual fund tax liabilities can be incurred through fund distributions or when liquidating units/shares for a profit. Investors should consult with a financial professional or tax advisor about the tax consequences of buying and selling mutual funds.

References

The articles below were referenced in preparing this information and are excellent resources to better understand this topic.

- Seeking Alpha: How Capital Gains on Mutual Funds Work | Seeking Alpha

- The Balance: What Are Mutual Fund Capital Gains Distributions? (thebalance.com)

- Hartford Funds: Hartford Funds 10-things-you-should-know-about-capital-gains

*This content was developed from sources believed to be providing accurate information. The information provided is not intended as tax or legal advice, and readers are encouraged to seek advice from their own tax or legal counsel. Neither the information presented, nor any opinion expressed, constitutes a representation by us of a specific investment or the purchase or sale of any securities. Asset allocation and diversification do not ensure a profit or protect against loss in declining markets. This material was developed and produced by Eustace Advisors to provide information on a topic that may be of interest. Copyright 2024 Eustace Advisors.